Understanding Guarantee Management System (GMS) of CGCC

December 1, 2023Understand Credit Guarantee

A business cannot grow to its full potential without technology. CGCC is not an exception. “Information technology and business are becoming inextricably interwoven. I don’t think anyone can talk meaningfully about one without talking about the other”, said Bill Gates, founder of Microsoft. Since the first day of its operation, CGCC has embraced information technology, starting with the basic functions of Excel spreadsheets and Microsoft SharePoint to manage credit guarantee operations. Today, CGCC hit a new milestone by launching the Guarantee Management System (GMS) to further leverage information technology for effective credit guarantee operation. Technology adoption is our commitment to play a small part in supporting the key priorities – People, Road, Water, Electricity, and Technology – of the “Pentagonal Strategy – Phase I” of the new Royal Government of Cambodia.

What is GMS?

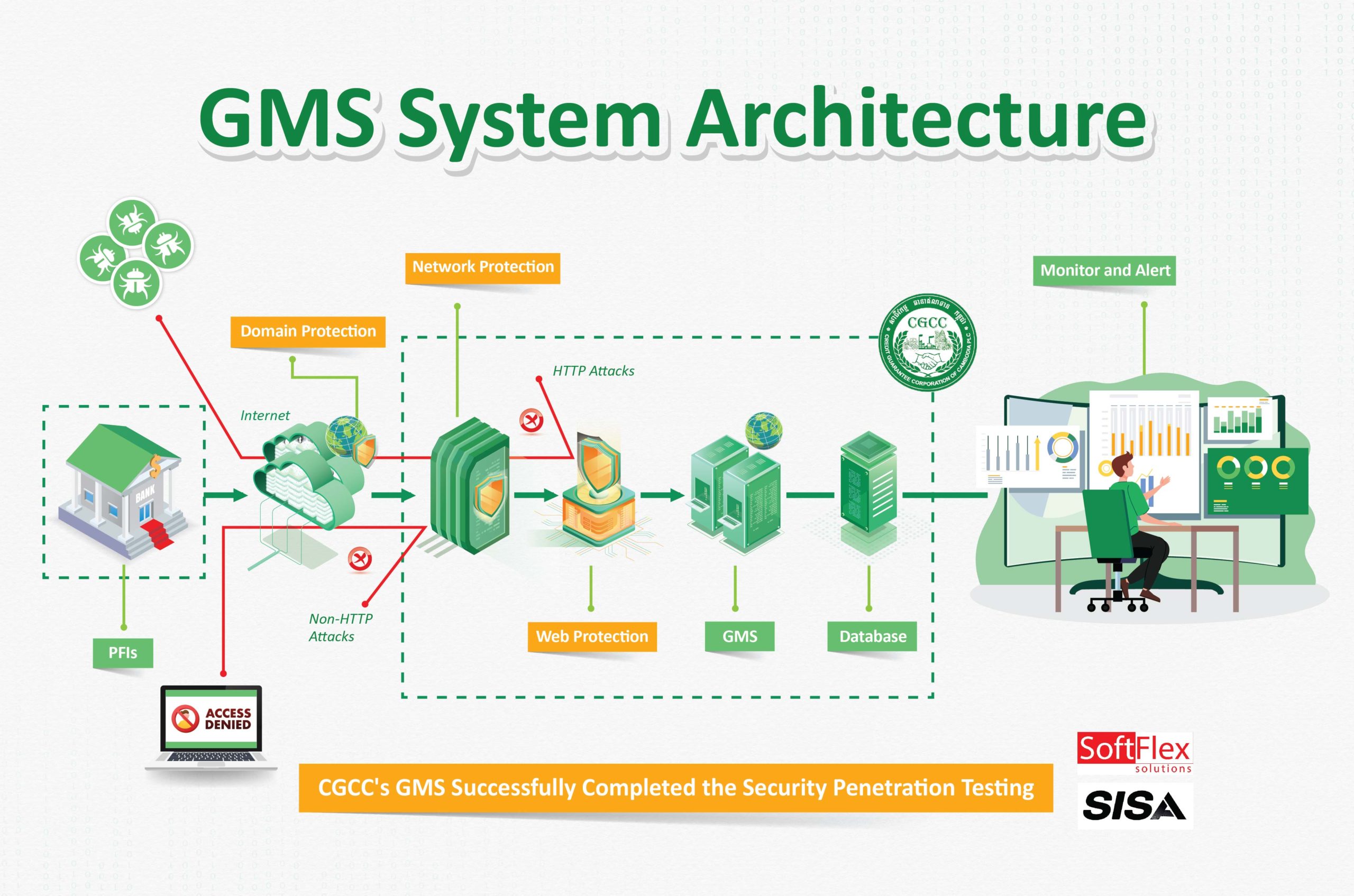

GMS is a digital platform that automates and streamlines the credit guarantee process, making it more convenient, faster, and more secure. It is the first-ever and only digital platform to manage a credit guarantee operation in Cambodia, tailored explicitly to CGCC’s credit guarantee model. It is a web-based system developed using microservices architecture and modern technologies to improve the guarantee process’s efficiency, accuracy, and security.

How was GMS developed?

. End-to-end automation: The GMS automates the guarantee application process, from PFI’s submission to CGCC’s approval. Furthermore, auto validation of CGCC’s scheme features is integrated to reduce error and time consumption when composing and reviewing the guarantee application.

. Real-time tracking: The GMS provides real-time monitoring of the status of all guarantee applications, allowing users to stay updated on the progress of each application and request.

. Comprehensive reporting: The GMS provides comprehensive reporting on all credit guarantee activities, allowing users to track the performance of guaranteed loans and identify areas for improvement.

. High security: The GMS is hosted on a secure platform and uses the latest security technologies to protect user data.

Read more: Understanding GMS of CGCC