High-ticket Loans of $50,000 Issued as Credit Guarantee Scheme Kicks off

April 25, 2024Latest News

To boost startups and SME entrepreneurs, more high-ticket (above $50,000) loans without property collateral are now being issued by microfinance institutions (MFIs).

The main reason behind this is the take-off of the Credit Guarantee Corporation of Cambodia (CGCC) for SMEs. Normally, MFIs would only give small-ticket loans between $1,000-$3,000 without property collateral.

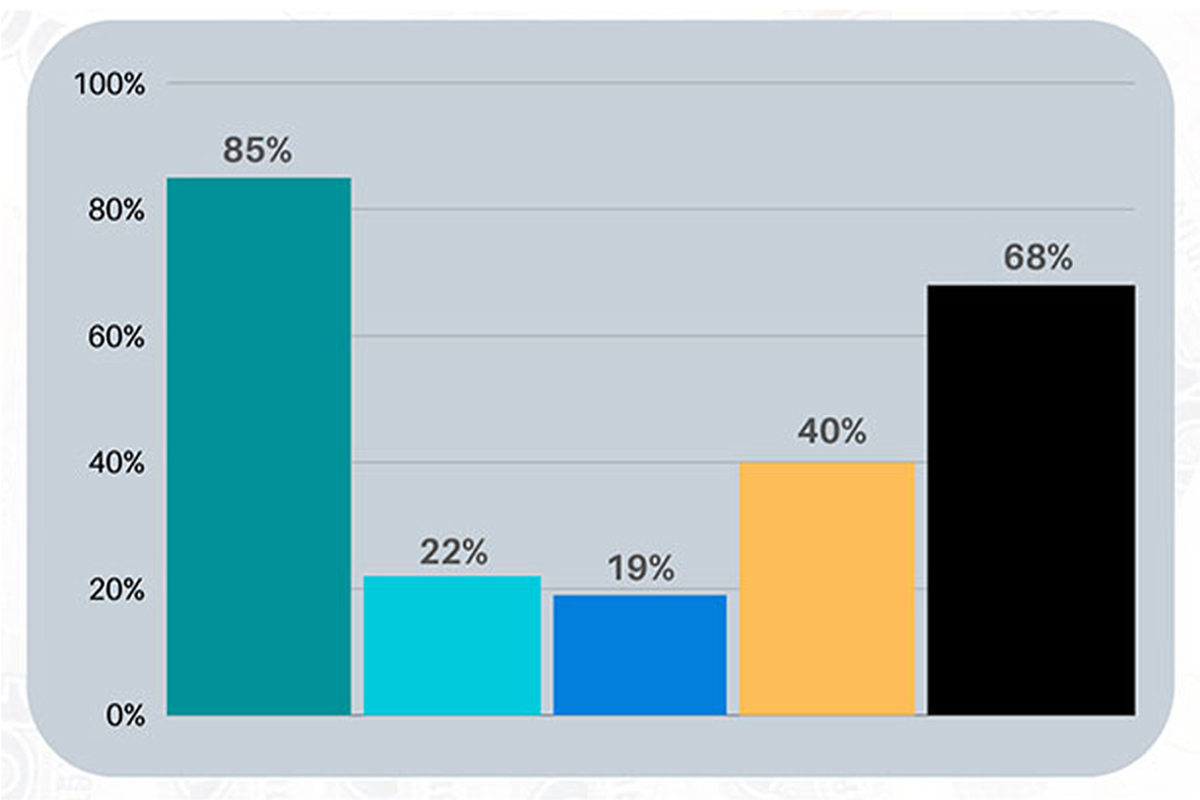

In the last decade, the higher the loan amount more would be the property collateral asked for. So looking at data from the fourth quarter of 2024 from the Cambodia Microfinance Association (CMA), for tier-1 loans less than $3,000 — 85 percent of these loans were issued without property backing it as collateral. Then for tier-2 loans between $3,001-$10,000 – 22 percent of loans were issued without collateral. And for tier-3 loans between $10,001-$50,000 – only 19 percent of such loans were issued without property collateral.

So far the data is following the expected trend as in past years. But if one were to look at tier-4 loans – which are above $50,000 – as high as 40 percent of loans were issued without property collateral.

And this is primarily because the CGCC in a bid to promote new ideas and new businesses has stepped forward to guarantee loans amounting to $164 million to 1,928 micro, small and medium enterprises (MSMEs) in the last three years. CGCC CEO KL Wong told Khmer Times that guaranteeing such loans has resulted in SMEs creating jobs. “The loans we’ve guaranteed have resulted in more than 52,000 new jobs in Cambodia from the SMEs we support,” he said.

Heng Bombakara, First Deputy Director General of Banking Supervision, National Bank of Cambodia (NBC), also said that the creation of CGCC is an acknowledgement of the vital role SMEs play in the economy. “SMEs represent 70 percent of employment opportunities in the country and contribute 58 percent to our country’s GDP. And these SMEs operate in diverse fields like agriculture, industry and services; and CGCC has been created to give a boost to this sector,” he said at a recent event.

Mindful of the diversity of SMEs in the country, CGCC guaranteed as much as 50 percent of loans for SMEs in services and trade, 3 percent from agriculture, 7 percent from industry and the remaining 40 percent to other miscellaneous SMEs.

CMA said that many of its members, including LOLC Microfinance and AMK Microfinance are participating financial institutions in the CGCC’s scheme. CGCC saw its highest loan guarantee activity in March 2022 – when it guaranteed as much as 91 businesses for $8.3 million in loan.

CGCC CEO Wong said that this pace of lending was maintained in 2023 where the state-owned enterprise guaranteed $72 million in loan amount for 943 accounts.

Credit to: Khmer Times, Published on 24 April 2024